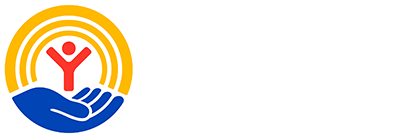

Help Denton County families maximize their federal tax refund without paying unnecessary tax service fees by volunteering with our Volunteer Income Tax Assistance (VITA) program.

Since 2008, our VITA program has successfully increased the economic mobility of struggling families by providing thousands of dollars of tax return which can be the catalyst to lift Denton County children out of poverty.

How to become a volunteer

Step One: All Denton County VITA volunteers must complete the volunteer registration form (below) and pass the background check each year.

Step Two: Sign up for Training (more details coming soon)

Step Three: Complete Tax Certification on IRS website (link coming soon)

Step Four: After certification, sign up for your specific volunteer location and times. (coming soon)

VITA Volunteer Needs

Our volunteers are essential to our mission. No experience is necessary to volunteer. If you sign up, we will teach you everything you need to know in order to file tax returns. Or you can help in a non-tax support role by preparing taxpayers for their session or translating for taxpayers with limited English proficiency. Click on the tabs below to learn more:

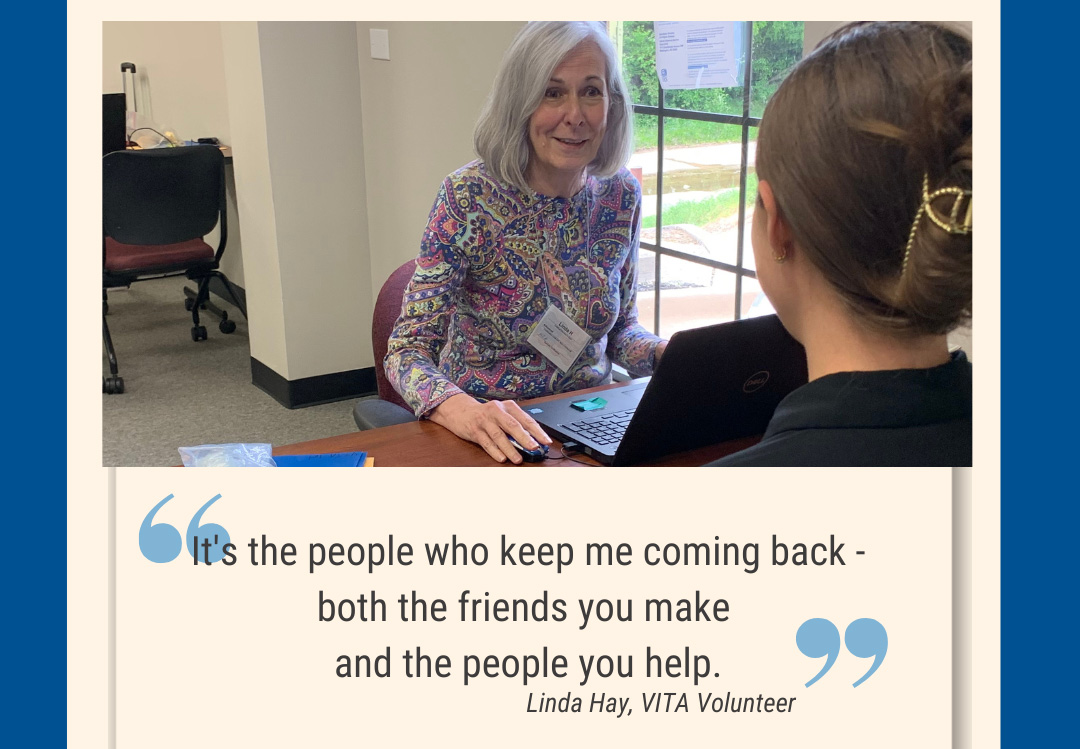

Volunteer Income Tax Assistance (VITA) tax preparers provide free tax help to working families and individuals in Denton County.

Requirements to be a Volunteer Tax Preparer:

- Basic computer skills

- Pass background check

- Attend trainings:

- First year volunteers: 9-12 hours of training and test prep

- Returning volunteers: Optional 3-4 hours of refresher training and test prep

- Certify each year as a volunteer tax preparer using online IRS software and testing

- Volunteer Standards of Conduct Exam (required)

- Intake / Interview & Quality Review Exam (required)

- Basic OR Advanced Exam (required)

- Foreign Student / International / Military / Puerto Rico (optional bonus certifications)

VITA Site Expectations:

- Ensure taxpayers eligibility

- Provide free, high-quality tax preparation services

- Request and provide peer quality review of returns prior to submission

Time Commitment:

- 3 hours of Orientation and Intake training

- 9 hours of IRS training to pass certification

- Returning volunteers: Optional 3-4 hours of refresher training and test prep

- Minimum 3 hours per week volunteering during tax season

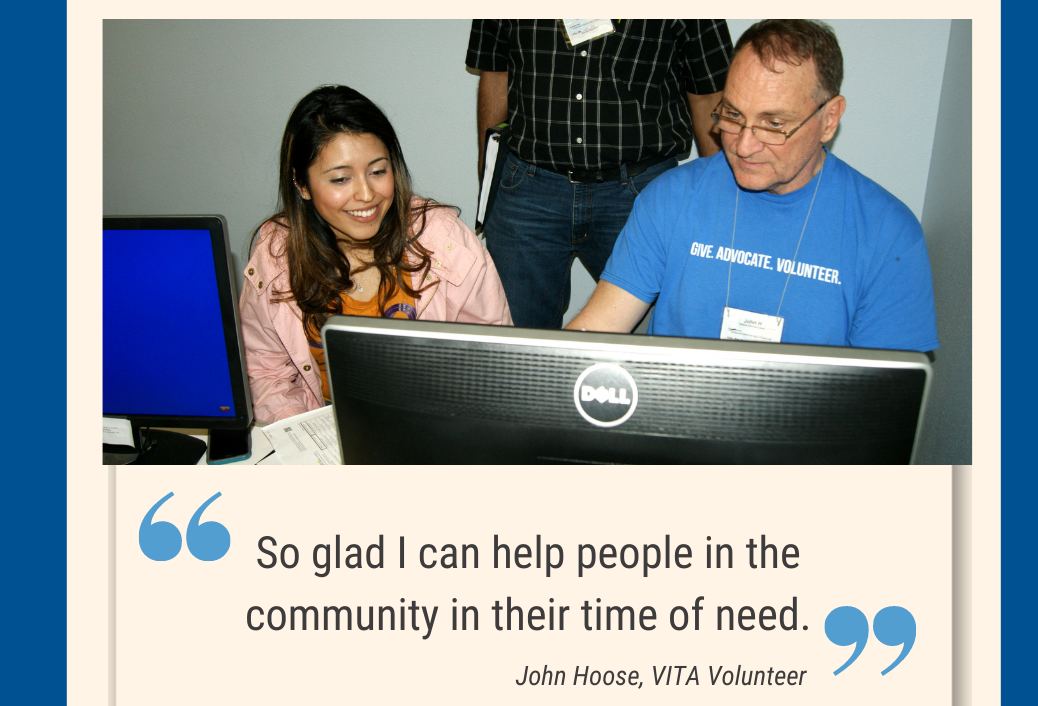

The VITA Greeter/Intake Specialists greet and screen all taxpayers to ensure they have the necessary information and documentation required to complete a tax return.

Requirements to be a Greeter & Intake Volunteer:

- Pass background check

- Attend trainings:

- First year volunteers: 3 hours of training and testing

- Returning volunteers: Optional 3-4 hours of refresher training and testing

- Certify each year as an intake volunteer using online IRS testing

- Volunteer Standards of Conduct Exam (required)

- Intake / Interview & Quality Review Exam (required)

VITA Site Expectations:

- Greet taxpayers in a courteous manner upon arrival and departure

- Maintain the taxpayer sign-in and queue

- Explain our tax preparation process and intake forms

- Help taxpayers make sure they've got all their documents

- Match taxpayers with appropriately certified volunteer tax preparers

- Consult site coordinators on any issues

- Maintain a smooth taxpayer experience in the intake and waiting area

Time Commitment:

- 3 hours of Orientation and Intake training and testing

- Minimum 3 hours per week volunteering during tax season

The VITA Translator provides free translation services to taxpayers not fluent in English or who need assistance understanding the tax preparation process and all the services available to them.

Requirements to be a Volunteer Translator:

- Conversational proficiency in both English and another language (especially Spanish or Chin)

- Pass background check

- Attend trainings:

- First year volunteers: 3 hours of training and testing

- Returning volunteers: Optional 3-4 hours of refresher training and testing

- Certify each year as an intake volunteer using online IRS testing

- Volunteer Standards of Conduct Exam (required)

- Intake / Interview & Quality Review Exam (required)

VITA Site Expectations:

- Greet taxpayers in a courteous manner upon arrival and departure

- Provide translation services to clients who are not fluent in English or may need assistance.

- Perform the duties of an Intake Volunteer when translation is not in demand

Time Commitment:

- 3 hours of Orientation and Intake training and testing

- Minimum 3 hours per week volunteering during tax season

If the webform does not load below, CLICK HERE to register as a free tax prep volunteer!

Our Volunteer Income Tax Assistance program is provided with the generous support of: